Just read the CLARITY Act and was impressed by how much technical detail Congress baked in.

CLARITY Act Summary

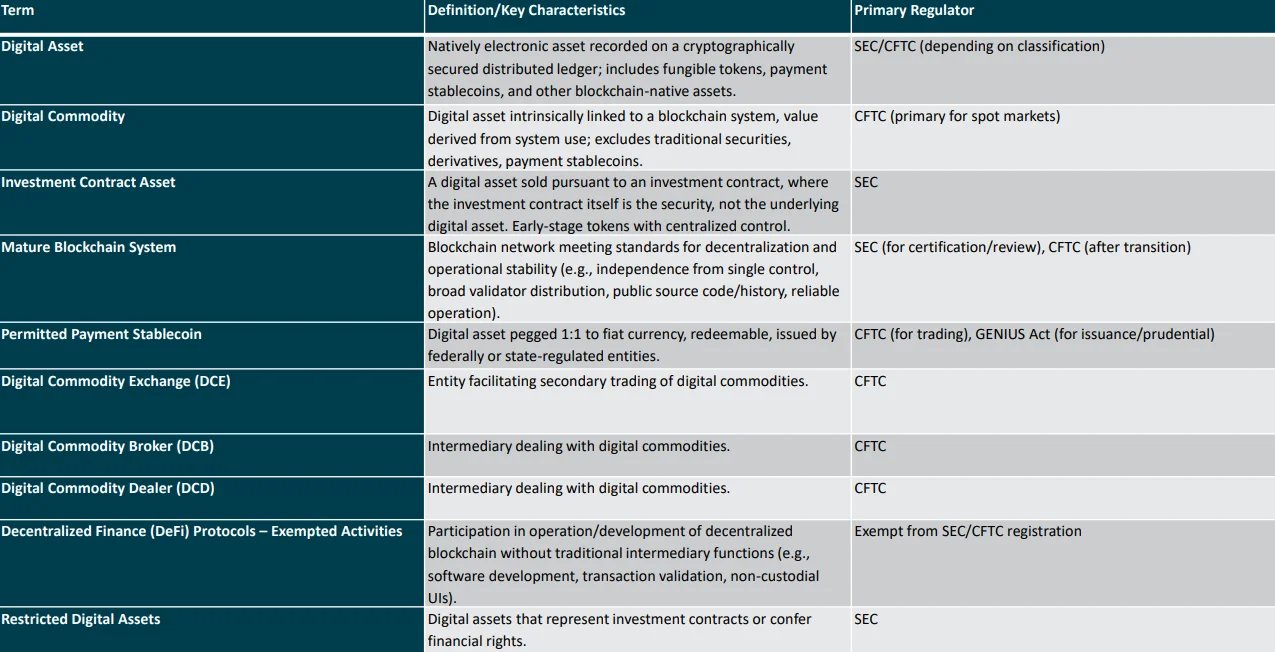

This table nails how SEC and CFTC responsibilities split across digital assets. A level of clarity this space has badly needed.

Token Trilemma

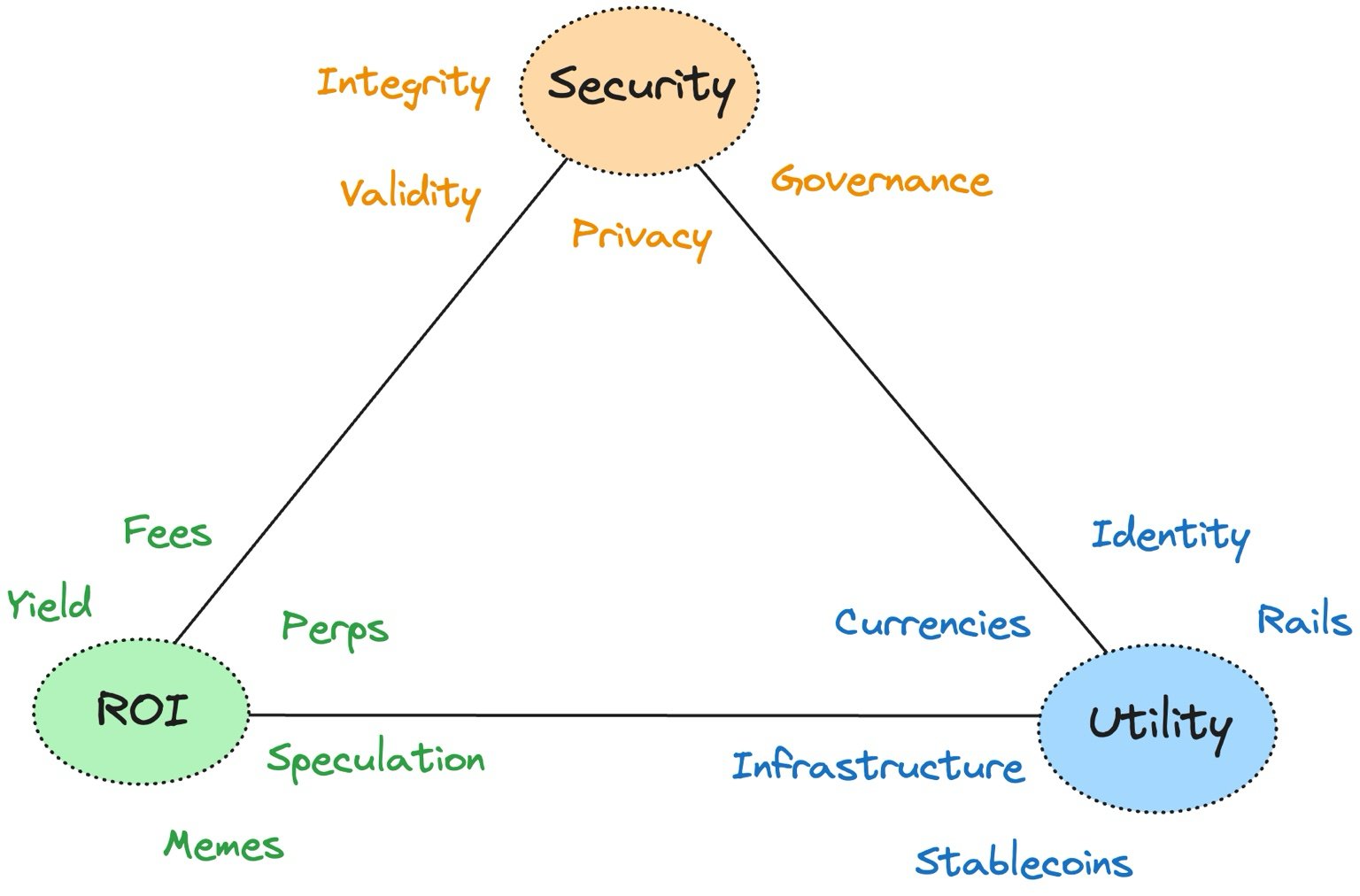

I break tokens into 3 buckets:

- ROI – speculation, memes, perps, yield 💰

- Utility – stablecoins, rails, infra 🔧

- Security – governance, integrity, privacy 🔒

The problem is the lines are blurry….

Discussion often scrambles all three. Until case law and precedent emerge, expect classification to be case-by-case.

I wouldn’t be surprised if a whole new consulting industry emerges. It will spring up just to map projects onto this new taxonomy.

Some other fun facts from the Act:

- Companies can raise $75M per year without SEC registration!

- Insiders trained is locked until mature blockchain status

- The Howey Test is being replaced with a Validator Decentralization Test

Terminology

- SEC: Securities & Exchange Commission

- CFTC: Commodity Futures Trading Commission

- Howey Test: A test used to determine whether a security is an investment contract or a commodity

- Validator Decentralization Test: A test used to determine whether a token is a security or a commodity

Links

Follow Me

You can subscribe to my Substack, follow my RSS feed, or join my email list for those really special updates: