Prelude

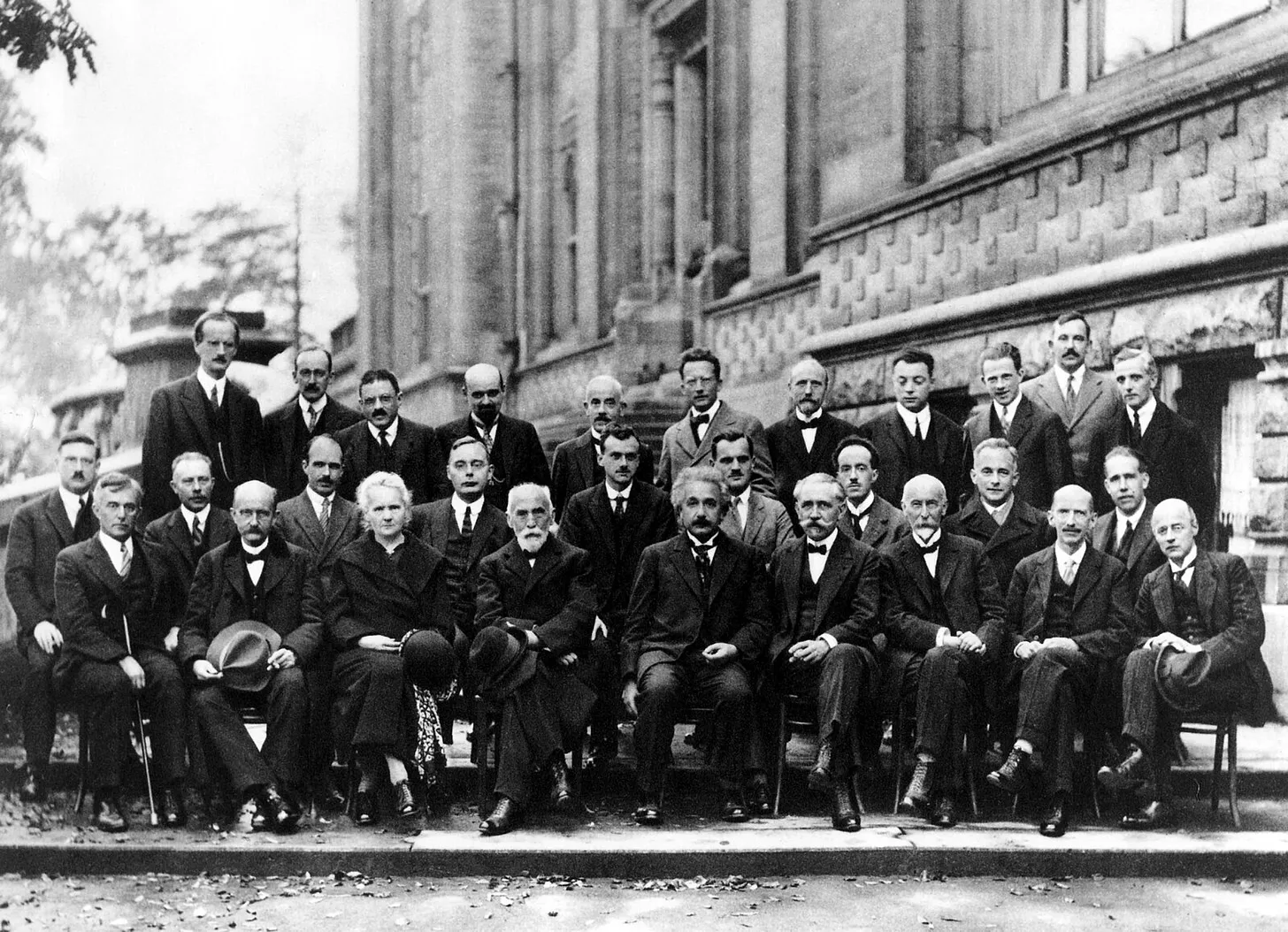

One of my favorite historical photos of all time was taken in 1927, at the fifth Solvay Conference, focused on Electrons and Photons.

You will likely recognize many of the names in that photo: Bohr, Curie, Dirac, Einstein, Heisenberg, Schrödinger. Seventeen of the twenty-nine attendees went on to win Nobel Prizes.

The golden era of quantum physics unfolded in the first half of the 20th century. A tremendous amount of progress has been made since, but I would argue that most of it has been engineering rather than foundational research. We are unlikely to ever witness a period quite like that again. That gathering of legends laid the groundwork for quantum theory for centuries to come.

There will be future breakthroughs in physics, but it will never feel the same. Most fields follow a similar arc. Art, film, science, business, technology, almost anything you can name, all have a zero-to-one phase where a small group of pioneers defines the landscape. What follows are decades of refinement, optimization, and iteration. If you are reading this today, we are watching that transition happen in real time in AI.

That realization got me thinking about who the remaining living legends are in other fields today.

Table of Contents

- Warren Buffett (1930–present) | Berkshire Hathaway

- George Soros (1930–present) | Soros Fund Management

- Ed Thorp (1932–present) | Princeton/Newport Partners

- Carl Icahn (1936–present) | Icahn Enterprises

- Ray Dalio (1949–present) | Bridgewater Associates

- Charlie Munger (1924–2023) | Berkshire Hathaway

- Jim Simons (1938–2024) | Renaissance Technologies

Finance & Investing: Living Legends

I got deeply into finance and investing around 2014, so this felt like the right place to start. I wanted to reflect on where we are today, and who quietly laid the foundations we still build on.

The individuals below are the ones who invented and defined the major forms of investing we take for granted today: value, quantitative, activist, macroeconomic, speculative, and more. Without them, we would not have the mental models, frameworks, or financial instruments that now feel obvious and inevitable.

What looks like common knowledge today was once a sharp break from orthodoxy. These people didn’t just outperform markets. They changed how markets are understood.

Warren Buffett (1930–present) | Berkshire Hathaway

Who he is: Value investor. Chairman and CEO of Berkshire Hathaway. Relentless reader with rare discipline, patience, and clarity of thought.

Impact: He modernized value investing and popularized its philosophy. He evolved from Ben Graham’s “cigar butt” approach to owning high-quality businesses with durable moats, long time horizons, and exceptional capital allocation.

Best Investment: Coca-Cola and Apple. Coca-Cola turned a ~$1.3B investment into ~$25B plus ~$800M+ in annual dividends. Apple generated well over $120B in unrealized gains on a cost basis of ~$40B.

Best Resource: Berkshire Hathaway Annual Shareholder Letters (1977–present). Still the clearest writing on investing, management, and temperament available.

Numbers: As of writing, his net worth is ~$150B. Berkshire Hathaway market cap ~$1.07T.

George Soros (1930–present) | Soros Fund Management

Who he is: Hedge fund manager best known for macroeconomic speculation. Operates at the intersection of markets, politics, and currency regimes rather than company fundamentals.

Impact: Soros became famous for “breaking the Bank of England” on Black Wednesday in 1992, earning roughly $1B by shorting the British pound and forcing the UK out of the European ERM (Exchange Rate Mechanism). More importantly, he introduced the theory of reflexivity, arguing that market participants’ beliefs actively shape prices and fundamentals, creating self-reinforcing feedback loops.

Best Trade: Shorting the British pound in 1992. A rare example of a single investor forcing a central bank to abandon an unsustainable peg by correctly identifying an unsustainable policy regime.

Best Resource: The Alchemy of Finance. The book lays out reflexivity and explains why markets are not efficiently self-correcting.

Numbers: As of writing, his net worth is ~$7.5B. The soros Fund Management has ~$28B AUM (Assets Under Management).

Ed Thorp (1932–present) | Princeton/Newport Partners

Who he is: Mathematician, hedge fund manager, and pioneer of quantitative investing. One of the first people to apply rigorous probability theory to both gambling and financial markets.

Impact: Thorp invented modern card counting in blackjack and built one of the first wearable computers to beat casinos in the early 1960s. He carried the same probabilistic thinking into markets by building one of the first quantitative hedge funds decades before they became mainstream.

Best Resource: A Man for All Markets. Part autobiography, part math primer, part investing philosophy. It connects gambling, quantitative finance, and risk control.

Numbers: As of writing, Thorp’s net worth is ~$800M, and PNP had ~$250M AUM at its peak in the 1970s.

Carl Icahn (1936–present) | Icahn Enterprises

Who he is: “Corporate raider” turned activist investor. Built a career by acquiring large stakes in underperforming companies and forcing change through pressure, proxy fights, and board influence.

Impact: Icahn pioneered modern activist investing. He showed that concentrated ownership combined with public confrontation could unlock value or extract it by reshaping management, capital structure, and strategy.

Best Trade: Trans World Airlines (TWA) in the 1980s. Icahn accumulated a large stake, took the company private with heavy leverage, sold assets, paid himself dividends and fees, and later exited while retaining a discounted ticket resale agreement that siphoned revenue for years.

Best Resource: King Icahn: The Biography of a Renegade Capitalist. An account of how activism actually works.

Numbers: Net worth ~$5B. Icahn Enterprises market cap ~$5B.

Ray Dalio (1949–present) | Bridgewater Associates

Who he is: Founder of Bridgewater Associates, the world’s largest hedge fund for much of modern history. Macro investor focused on currencies, rates, and global economic debt cycles.

Impact: Dalio built systematic frameworks for understanding debt cycles and monetary policy. Bridgewater was one of the first companies to implement “radical transparency” at scale, and he was one of the first to signal the growth of China’s economy.

Best Investment: The long bond bull market. Bridgewater is known for risk parity and global macro positioning, so they bought a lot of 15% 30 year bonds in the 1980s; this is known as systematic duration exposure.

Best Resource: Principles. Part manual, part philosophy, part autobiography.

Numbers: Dalio’s net worth is ~$15B. Bridgewater has ~$124B AUM.

Honorary Mentions

Charlie Munger (1924–2023) | Berkshire Hathaway

Who he was: Vice Chairman of Berkshire Hathaway and longtime partner of Warren Buffett. Lawyer by training, investor by temperament, and relentless thinker. His was Buffett’s philosophical right hand brain.

Impact: Munger reshaped modern value investing alongside Buffett. He pushed Buffett away from pure “cigar butt” investing toward owning buying exceptional businesses at great valuations.

Best Investment: Costco and BYD Auto Company.

Best Resource: Poor Charlie’s Almanack. A timeless collection of talks and ideas on investing, decision-making, and human psychology.

Numbers : Charlie’s net worth was approximately $2.3B when he passed away.

Jim Simons (1938–2024) | Renaissance Technologies

Who he was: Mathematician and founder of Renaissance Technologies. Built the most successful quantitative hedge fund ever by recruiting scientists, not traders. Very quiet and solitary throughout his life.

Impact: Simons was one of the first to show how machine learning, proprietary data and long-term corporate incentive structures lead to sustainable returns.

Best Investment: The Medallion Fund. It’s closed to outside investors, but compounded at roughly ~66% gross (~39% net) annually for decades, making it the most profitable investment vehicle in financial history.

Numbers: Simons’ net worth was ~ $31B when he passed away. Renaissance managed ~$100B+ AUM at its peak (early 1990s) primarily through external funds.

Best Resource : The Man Who Solved the Market.

Footnote

This list is intentionally short and opinionated. I’m trying to capture the lessons from people who have shaped my thinking over time, not to catalog every great investor.

For example, Stanley Druckenmiller and Peter Lynch are well-known and highly respected figures, but their work didn’t influence my framework as much as those already included here.