tl;dr Investing in the S&P 500 is more profitable than buying a condo in Toronto with a 25% downpayment and renting it out while still paying for rent in San Francisco over a 10 year term.

Everyone I’ve ever met can agree on one simple fact: it’s important to save money. However, it is well known that letting money sit around in a checking or savings account is pretty close to wasting it. Most interest rates offered nowadays don’t even account for inflation, so you find yourself in a use it or lose it type of situation. Luckily, there are plenty of investment opportunities all around us. Some people opt to invest in real estate, others like to invest in a select thoroughly researched companies, and the rest just put everything in index tracking funds. While investing in individual stocks can be a lot of fun, it requires more effort and continuous maintenance. I decided to investigate and compare a couple of the more passive investment opportunities: real estate and index funds.

Background

As an inexperienced real estate investor, I chose to only look at the cities where I have lived for a considerable amount of time: Toronto and San Francisco. This is primarily because given the lack of my investment experience, I am only comfortable with buying real estate when I have an intuitive understanding of where the evaluation stands, what the availability is like, where future development is headed, and how different areas of the city compare to each other. I compared the real estate markets in these two cities against several index funds, which are a considerably safe investment when it comes to stock investment. Index funds do not revolve around speculation, they rarely require any maintenance, and growth is considerably better than most alternatives such as bonds; provided that the market doesn’t crash of course.

For the purposes of simplifying my analysis, I chose to ignore taxes and inflation. Whatever effects inflation may have on my earnings will apply to either of my investments, and while I am aware that taxes can create a much greater discrepancy in my returns, especially depending on the type of investment (short-term, long-term, income, property, stocks, local, foreign, etc…) I make, I only took major taxation factors into consideration to determine whether whether one investment is significantly better than the other.

All of my assumptions are based on long term historical patterns, which may not uphold in the case of a bubble or a crash. I did not account for this risk factor, and seeing how there is not much I can do to circumvent it, I decided to ignore that scenario altogether.

Index Funds

I chose to evaluate the growth of three major indices: S&P 500, DJI, Russell 3000. All of this data was collected from finance.yahoo.com.

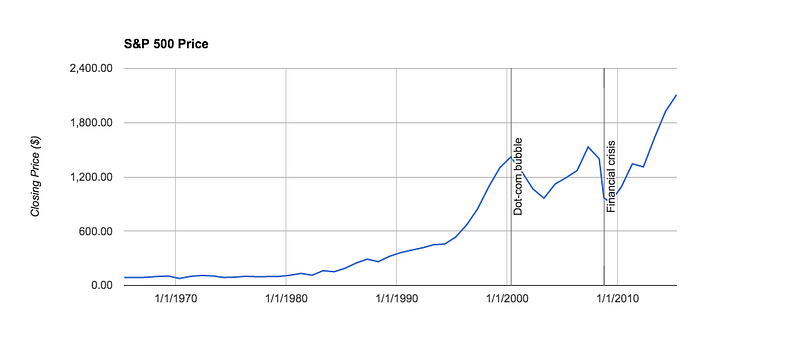

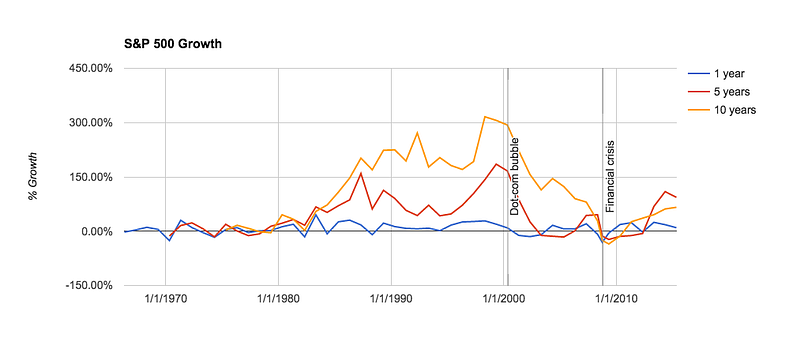

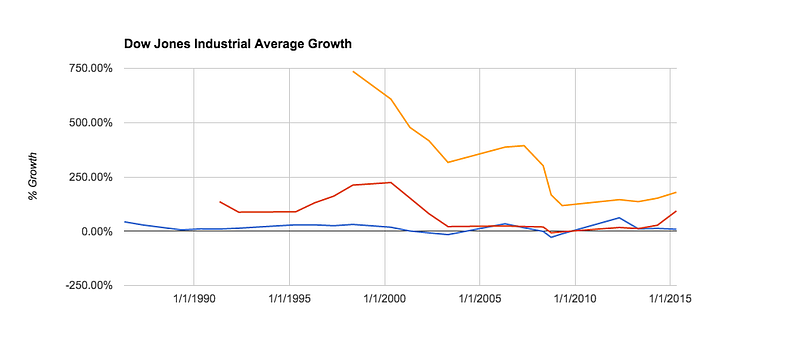

From the graphs below, it looks like the 90s were a great turning point for our economy during which it really bloomed for the first time. Since then it’s been a little bit of a rollercoaster with the dot-com bubble and financial crisis of 2008 really leaving their mark. That being said, if the trends uphold, I anticipate that we’ll still see strong growth over the next decade or so.

Most of these graphs speak for themselves, so I didn’t bother annotating them.

Summary

S&P 500

The S&P 500 index currently tracks 502 of the public companies in the US.

Dow Jones Industrial Average

The Dow Jones Industrial Average index currently tracks 30 of the largest public companies in the US.

Russell 3000

The Russell 3000 index currently tracks 3000 publicly held US companies, which account for about 98% of the investable US equity market.

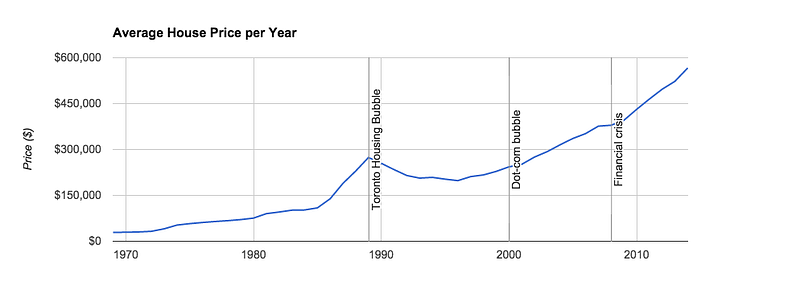

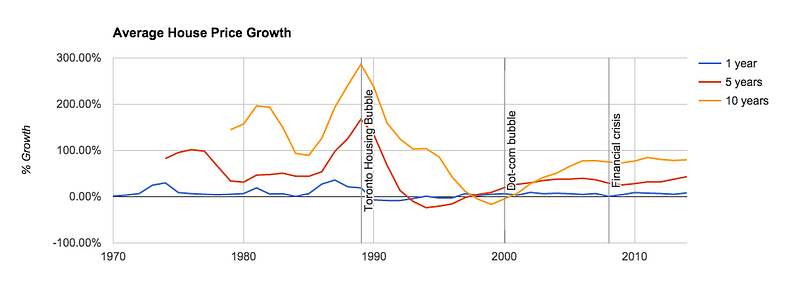

House Prices

This data is less reliable than that above, and it’s important to note that house prices, unlike stocks, have a lot of locality associated with them. They vary very greatly by neighborhood, surrounding schools, house condition, neighbors, weather, accessible transportation, etc… In addition, there are different types of houses, including freeholds, condos and townhouses, which adhere to a very different sets of rules and are therefore priced very differently. That being said, I was more interested in getting a broader picture of the real estate market before I delved into region specific research.

Summary

Toronto

The only interesting thing to note here is the crash of the housing bubble in 1989. A combination of population growth, immigrant influx, low unemployment rates, introduction of women into the workforce, and general income growth caused house prices to surge during the 80s followed by a crash that took years to recover from. Otherwise, it looks like the real estate market in Toronto has recovered and been growing at a stable rate for a good number of years now.

San Francisco

I couldn’t find reliable data for the the number of house sales per year in San Francisco, so I omitted that graph completely. In case you are interested in seeing this data, Trulia has some of it available here.

As expected, there was a huge dip in 2008, which the market is only beginning to fully recover from now. Growth is a little unpredictable, but should presumably improve over the next few years given the high demand for housing, the lack of supply, and the continued growth of the prominent tech industry in SF.

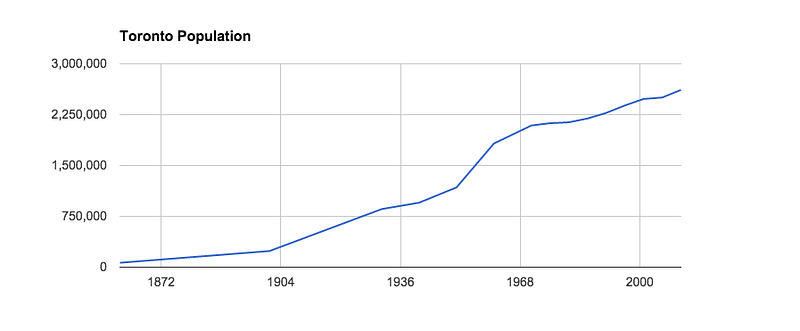

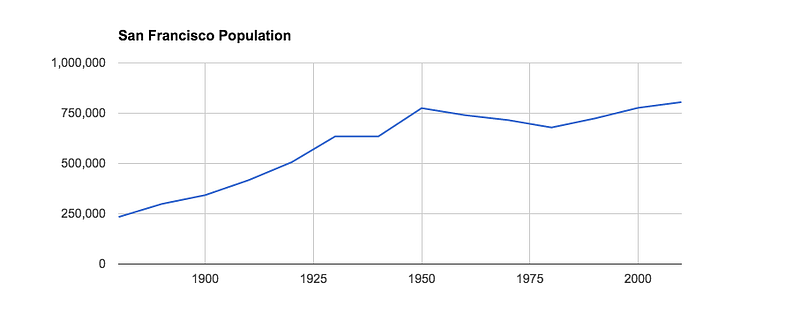

Population

I decided to very briefly look at population growth because it is arguably one of the most detrimental figures that contribute to the growth of real estate. If population growth decelerates or stalls completely, then rising house prices are very likely to just be speculative and will end up falling in the long run. However, if population grows faster than house prices, I would expect the market to either remain in a healthy state, or grow at a steady pace, if not better. In addition, when Warren Buffett was asked about his opinion on investment in real estate, he said that he is very hopeful that humankind will continue reproducing as it has in the past, which is more than enough evidence for me. :p

If I had wanted to be rigorous, I would analyze all the different contributors to population growth separately. Natural population growth, immigration / emigration and life expectancy all affect population in very different ways. I would also look into population density, zoning laws for construction, and how the GTA (Greater Toronto Area), and the San Francisco Bay Area factor into the main city’s working and living population. However, once again, I just wanted to get an overall idea of where the population is heading.

Toronto’s population is definitely growing at a much faster rate, and there is more potential for further growth in the future. That being said, while the lack of supply and limited space in San Francisco limits population growth, prices will keep rising as demand continues to increase and the tech industry prospers.

Summary

Toronto

Toronto Area: 630.21 km2

San Francisco

San Francisco Area: 121 km2

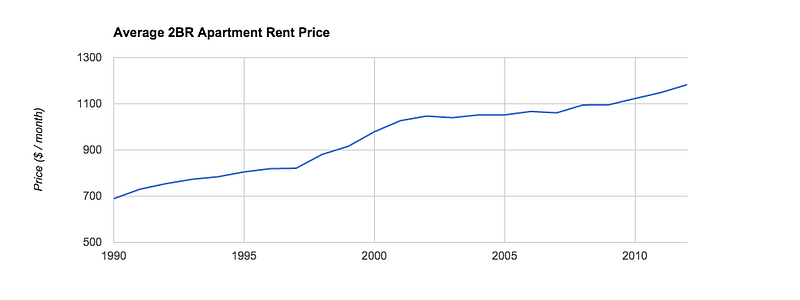

Rent

Seeing how I am currently renting in the city of San Francisco, and may potentially be renting out the property that I buy (if I don’t live in it), I took the growth of rent prices into consideration.

As a disclaimer, this is the data I probably have the least confidence in, but I still wanted to share what I found.

From the data below, there is a clear upward trend for the price of rent in both cities. However, while the price of rent in Toronto seems to be stabilizing, the price of rent in San Francisco is skyrocketing.

Summary

Toronto

San Francisco

Robo Advisor Platforms

In addition to some of the major indices in the US market, which is what I am comparing real estate against, I thought it was worth mentioning a couple other options that have been gaining popularity lately: Betterment and Wealthfront.

Both of these companies offer to manage your money for a small service fee. Betterment charges 0.35% for any account with a balance under $10,000, 0.25% for any account under $100,00 or 0.15% otherwise. Similarly, Wealthfront charges a monthly advisory fee based on a 0.25% annual rate on any funds over $10,000.

Both of these services utilize the Modern Portfolio Theory as the basis for their investment, and invest primarily in index funds. While The Essays of Warren Buffett: Lessons for Corporate America has a few arguments against this approach to investing, it has it’s upsides as well. According to Betterment, comparing low-cost market-tracking index funds vs actively managed mutual funds which try to outperform the market showed that “overwhelming evidence is found in support of an all index fund strategy.” There are also other benefits from utilizing these services such as tax loss harvesting for example.

Wealthfront advertises projected earnings of 4.37%, 23.79%, and 52.94% over the next 1, 5 and 10 years respectively. While this is lower than the S&P 500 (calculated above), it is also safer because risk is greatly reduced through diversification and active rebalancing of the portfolio. For this reason, it could serve as another low risk alternative. Similarly, Betterment’s historical data shows that “investing in a Betterment 100% stock portfolio since the end of Jan 2004 through the end of Apr 2015 would have produced a cumulative return of +135.1%, which is the same as an average annual return of +7.9%.”

Which is better?

Where?

While doing my research, I decided that I am no longer interested in pursuing a real estate investment in San Francisco. Several different factors contributed to this decision. The only places I can afford are very small spaces, in very old structures, in areas of the city where I personally would not want to live. The effect of the booming tech industry is very prominent here, causing the prices to seem very inflated, and simply making me feel like I am overpaying based on speculation. The interest rates on mortgages in the US are relatively high (approximately 1.5% greater than they are in Canada), and are due to increase furthermore in the near future. Lastly, the Canadian real estate market was a lot more resilient to the 2008 crash, making it seem like the safer alternative. Therefore, if I were to go down the real estate investment path, it would be in Canada.

How Much?

When looking for a mortgage, I was quoted at 4% in the US and at 2.5% in Canada. To be conservative, I used 3% as the interest rate I would receive in Canada to account for all of the assumptions and corner cutting in my calculations.

If I were to buy a $400,000 condo with a $100,000 downpayment and a 1% property tax rate, I can use a handy mortgage calculator to determine that my monthly payment is $1,264.81. A property tax rate of 1% would add on $333.33/month, and assuming that the HOA condo fees are also approximately 1%, the total monthly payment adds to $1,930.81.

There are also a lot of other expenses that need to be factored in such as insurance fees, appraisal fees, closing fees, and others. For the sake of simplicity, let’s just say this amounts to 3% of the purchase price ($12,000), which I will factor in near the end.

The budget: Assuming the scenario outlined above, the budget I have to work with is a $100,000 upfront investment with a monthly allowance o $1930.81. Provided that my current rent is $1400/month, it is the cost that I will use as an alternative to buying a house. Also, let’s assume that the investment being made is over a 10 year period.

Case 1: Buy the house and live in it

Using a simple remaining principal calculator, and assuming the HOA fees and property tax (which I know are probably going to go up) remain the same, the remaining principal after 10 years is $228,059.05. As per the graph above, the 10 year return on a home in Toronto is 100%, bringing the home to a final price of $800,000. If I sell it at that price and pay of the remaining principal, I will have $571,941 remaining. That means that an initial investment of $100,000 plus a monthly payment of $1930.81 over 10 years, totalling $231,697.2, turned a profit of $240,024.38. Subtracting 3% of the final house price for closing fees and such, plus the 3% when I first bought the house, the final very crude profit is $204,024.38. Adjusted for 2% inflation, that’s $167,371.05 today.

Case 2: Keep renting, buy the house, and rent it out

After casually browsing craigslist, I determined it is likely that I could rent out the home I have consider buying to fully cover the monthly expenses I outlined above. While I do run the risk of having the apartment be vacant for a month or two at a time when looking for a tanant, I will argue that this risk is compensated by the fact that I will be able to increase rent over time, which is not something I am factoring into my returns. For the sake of simplicity, let’s assume that I find a tenant who signs a 10 year lease for $1930.81/month.

In the meantime, I would keep renting at my current location for $1400/month and assume an annual 5% (approximated from the data) rent increase. I would first be saving $500 a month, until rent reaches a turning point where the mortgage payment (plus HOA and property tax) is cheaper than my monthly rent. Assuming a budget of $1930.81 / month, I would save $23,281.2 over 10 years. But rather than just letting the money sit around, I could invest it in an index tracking fund (like the S&P 500) at the end of every year, which has an average year over year return of 7.58%. This would turn a profit of $37,006.2 minus $5,013.69 for the last 3 years when rent is greater than the mortgage, netting an extra $31,992.48 over case 1.

In my opinion this case isn’t really worth pursuing because the risk associated with not having a tenant, and the work that goes into finding a tenant, is simply not worth the hassle.

Case 3: Keep renting, invest the rest in stocks

Assuming the same rental situation as described in case 2, and the same budget, I could save the aforementioned $31,992.48 over 10 years with the monthly difference I save on rent versus having a mortgage. However, my $100,000 would grow to $207,642.10 assuming a 7.58% yoy growth in the S&P 500. Therefore, the resulting profit is $131,992.48. Adjusted for 2% inflation, that is $108,279.81 today.

Taxes

According to the Income Tax Act, I need to pay taxes on the capital gain income from my house investment. If I am in the “business of buying and selling homes”, there is a 100% inclusion rate, but if I reside in the house itself, there is only a 50% inclusion rate, meaning that either 100% or 50% of the growth of my property gets taxed. In addition, as a “worst case situation”, let’s assume that I’ll be in the highest possible marginal tax rate bracket, which is currently 43.7%.

With regard to taxation on long-term capital growth of stock, if my taxable income is under $406,750, then it is only taxed at 15%.

With that in mind, let’s reevaluate the three cases above.

Case 1

Assuming I am in the highest tax bracket, and the house I live in doubles in price, I will have to pay 43.7% in taxes at a 50% inclusion rate (on $200,000), amounting to $87,400. Therefore, the return on my investment decreases from $204,024.38 to $116,624.38.

Case 2

Similar to the situation above, except for the fact that I would have to pay taxes at a 100% inclusion rate (on $400,000), amounting to $174,800. In addition, I would have to pay 15% on the capital growth I have invested in stocks ($13,725), which is 2,058.75. This brings my overall returns down to $22,504.78. Taxes…

Case 3

This only involves paying 15% off $131,992.48, bringing my overall returns down to $99,130.

Other Thoughts

While real estate looked more favorable initially, the returns started diminishing very quickly as I started taking more factors into consideration, and it’s important to point out that the analysis I have above is still very crude and is purely an extension of average historical trends.

Another advantage of stocks over real estate is liquidity and ability to diversify. With stocks, one is able to invest in a variety of different companies across many different sectors. This makes the investment safer by mitigating the loss in case some sector is facing financial hardships, and increases the chance of success because if you invest in a thousand companies, a few of them are bound to do well. Also, if for some reason you need to gain immediate access to your funds, regardless of whether or not it’s a good time to sell, that option remains open. In addition, if a really good investment opportunity comes up, like $APPL dropping to $1 for some reason, you can very quickly seize the situation and shift businesses. It’s worth mentioning that stock also pay out dividends, which is not a benefit I accounted for.

Real estate, on the other hand, does not have any of the benefits mentioned above. It has smaller returns than the market, requires a greater startup capital, not very liquid (it takes time to sell), is taxed at a higher rate, and is more difficult to diversify. There are also incidental fees associated with maintaining a house that we never accounted for, which could potentially add up to a significant sum. There’s also the risk of not knowing how interest rates will change. However, with all of that said, it is potentially a safer and more stable investment in the long term.

Disclaimer: There is so much information available online that it is very easy to get overwhelmed, especially when you are first introduced to a field that you have little experience in. The number of investment options, evaluation techniques, and granularity of the data available is almost endless. For that reason, I limited the scope of my investigation to a very high level. I was trying to determine whether one option is objectively better than the other, and convince myself of what I should do. There are a lot of assumptions, and lots of rounding all over the place, so please take everything I said with a grain of salt.

References

[1] Index funds historical data. https://finance.yahoo.com

[2] Toronto historical house prices. http://www.torontorealestateboard.com/market_news/market_watch/

[3] San Francisco historical house prices. http://www.jparsons.net/housingbubble/san_francisco.html

[4] Toronto housing bubble. http://www.torontocondobubble.com/2013/02/toronto-housing-bubble-in-1980s.html

[5] Toronto population. http://en.wikipedia.org/wiki/Demographics_of_Toronto

[6] San Francisco population. http://www.sfgenealogy.com/sf/history/hgpop.htm

[7] Toronto rent history. https://www.cmhc-schl.gc.ca/en/co/buho/

[8] San Francisco rent history. http://marthabridegam.com/sf-rent-history-chart/

[9] Warren Buffet video. https://www.youtube.com/watch?v=cSU3y0N60XU

[10] Betterment pricing. https://www.betterment.com/advice-projection-methodology/

[11] Wealthfront pricing. https://pages.wealthfront.com/faq/

[12] Betterment Whitepaper. https://d9l6g2vjiqrcr.cloudfront.net/documents/BMT-PS_Whitepaper.pdf

[13] Wealthfront returns. https://www.wealthfront.com/plan/details

[14] Betterment returns. https://www.betterment.com/resources/investment-strategy/betterment-historical-performance/

[15] Mortgage calculator. http://www.mortgage-investments.com/resources/online-calculators/tutorial-choices/tutorial-4-calculate-the-payments-on-a-loan/

[16] Remaining principal calculator. http://www.mortgage-investments.com/resources/online-calculators/tutorial-choices/tutorial-5-calculate-the-principal-balance-left-on-a-loan-after-payments-made/

[17] Tax on Sale of Investment Property. http://www.balancecounts.com/tip.php?tax-on-sale-of-investment-property

[18] Tax on long-term capital gain. http://www.marketwatch.com/story/capital-gains-at-what-rate-will-your-long-term-sales-be-taxed-2015-02-18

[19] Yellen on interest rate. http://www.nytimes.com/2015/03/28/business/yellen-says-fed-will-increase-rates-slowly.html?_r=0